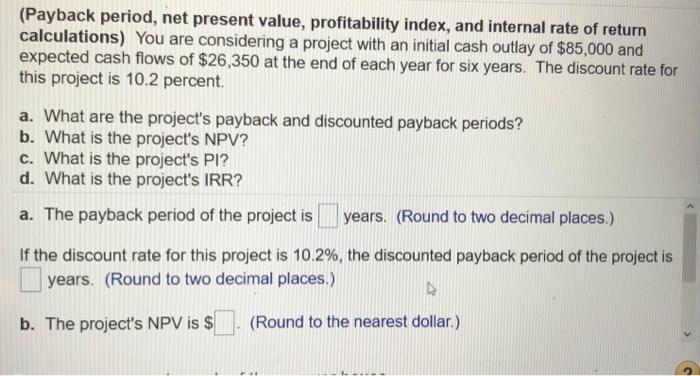

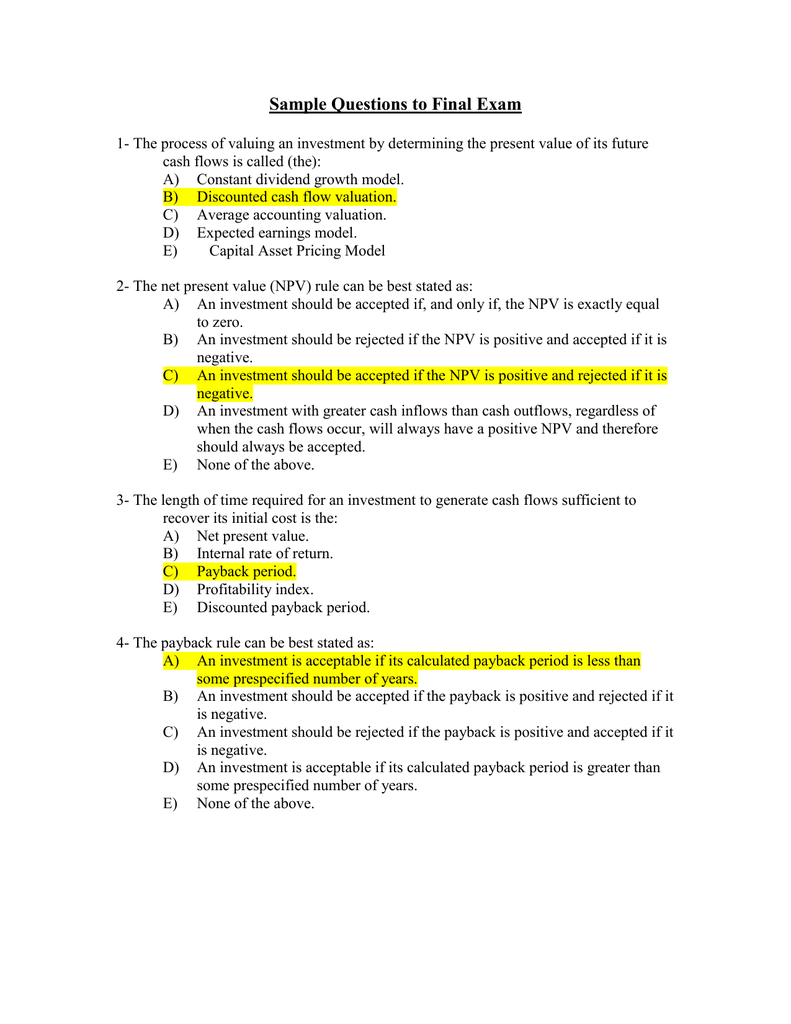

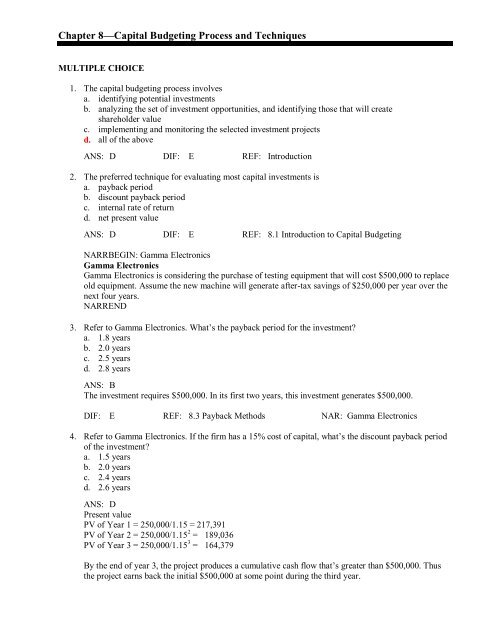

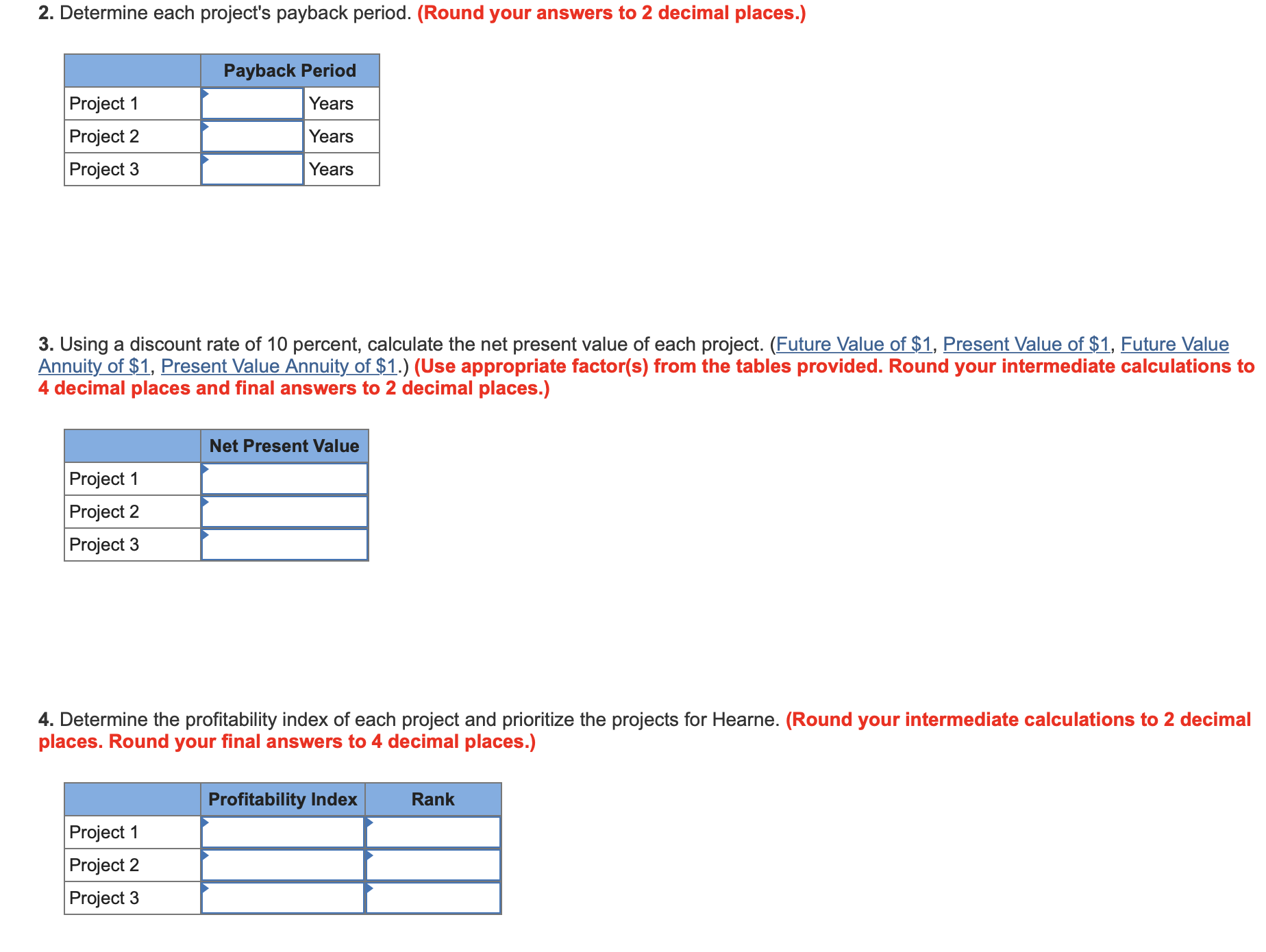

1 CHAPTER 5 Capital Budgeting Techniques. 2 Introduction to capital budgeting Payback period Discounted payback period Net Present value (NPV) Profitability. - ppt download

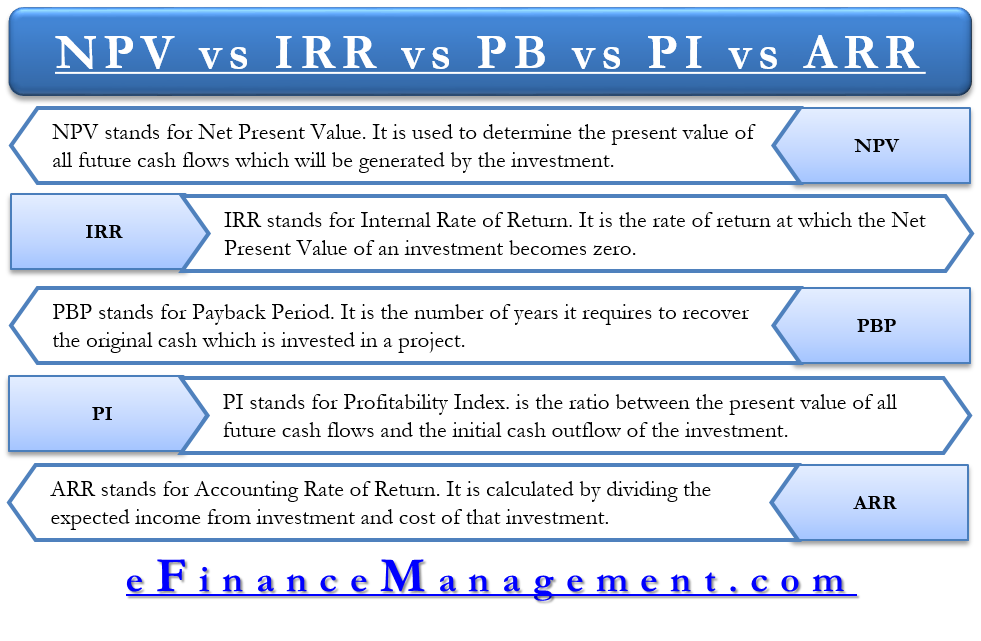

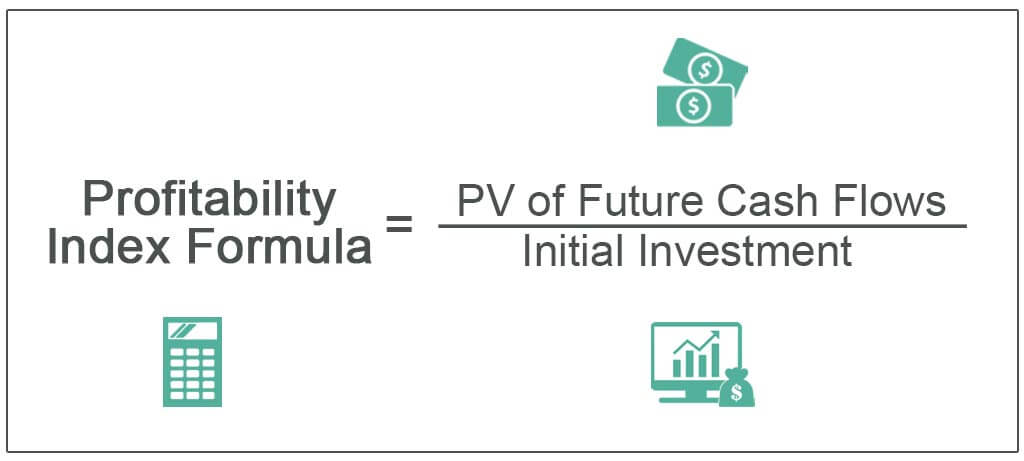

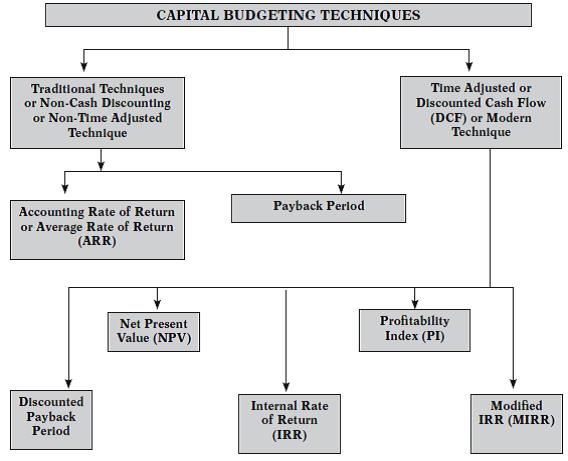

Net present Value, Internal Rate Of Return, Profitability Index, Payback, discounted payback, Accounting Rate Of Return

11-1 Capital Budgeting Professor Trainor Capital Budgeting Decision Techniques Payback period: most commonly used Discounted Payback, not as common. - ppt download

CAPITAL BUDGETING Decision methods: Payback period, Discounted payback period, Average rate of return, Net present value, Profitability index, IRR and Modified IRR (Theory & data interpretation): Sekhar, Chandra: 9781980203452: Amazon.com: Books