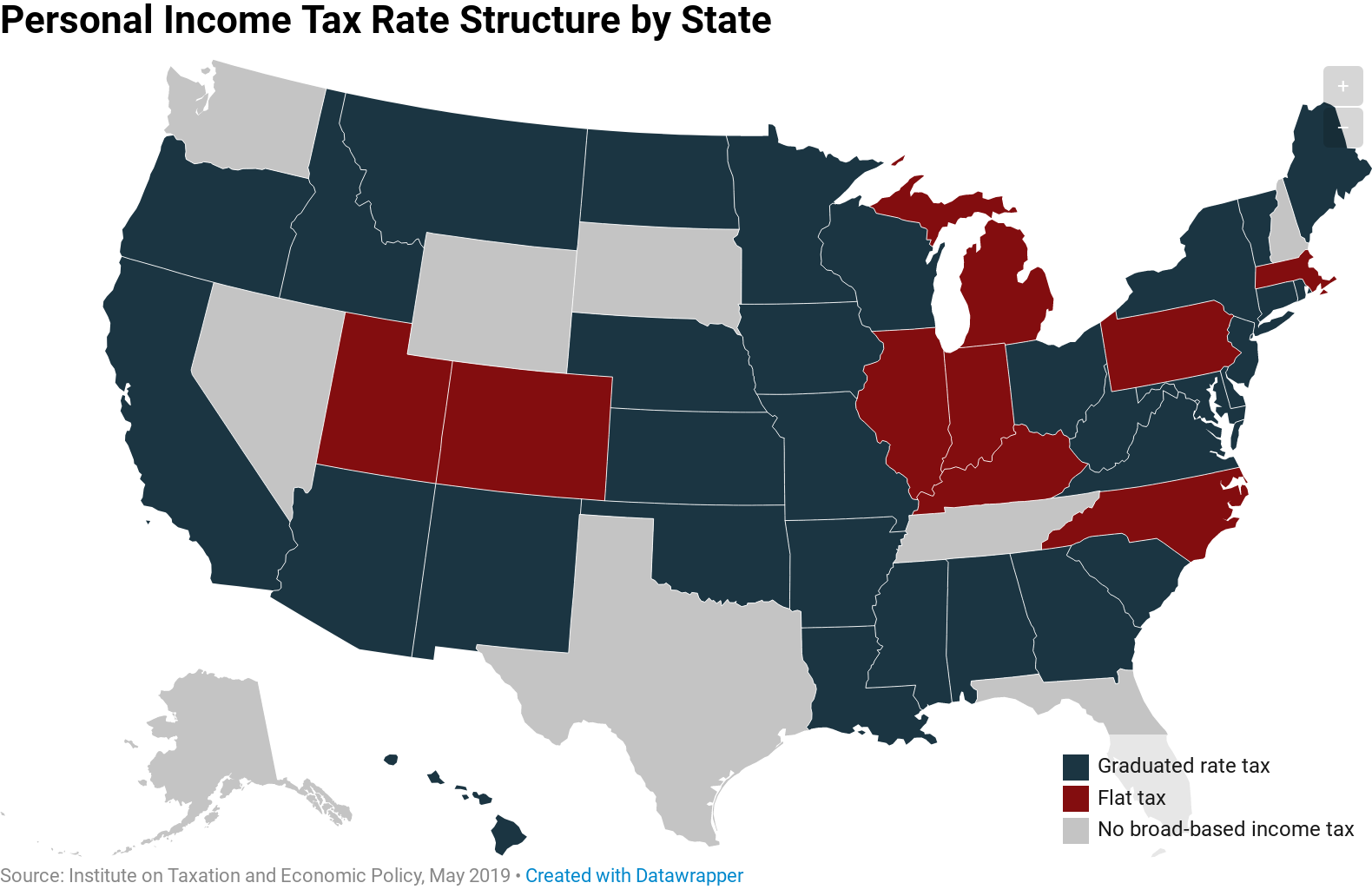

3. The design of the tax and benefit system in Lithuania | OECD Tax Policy Reviews: Lithuania 2022 | OECD iLibrary

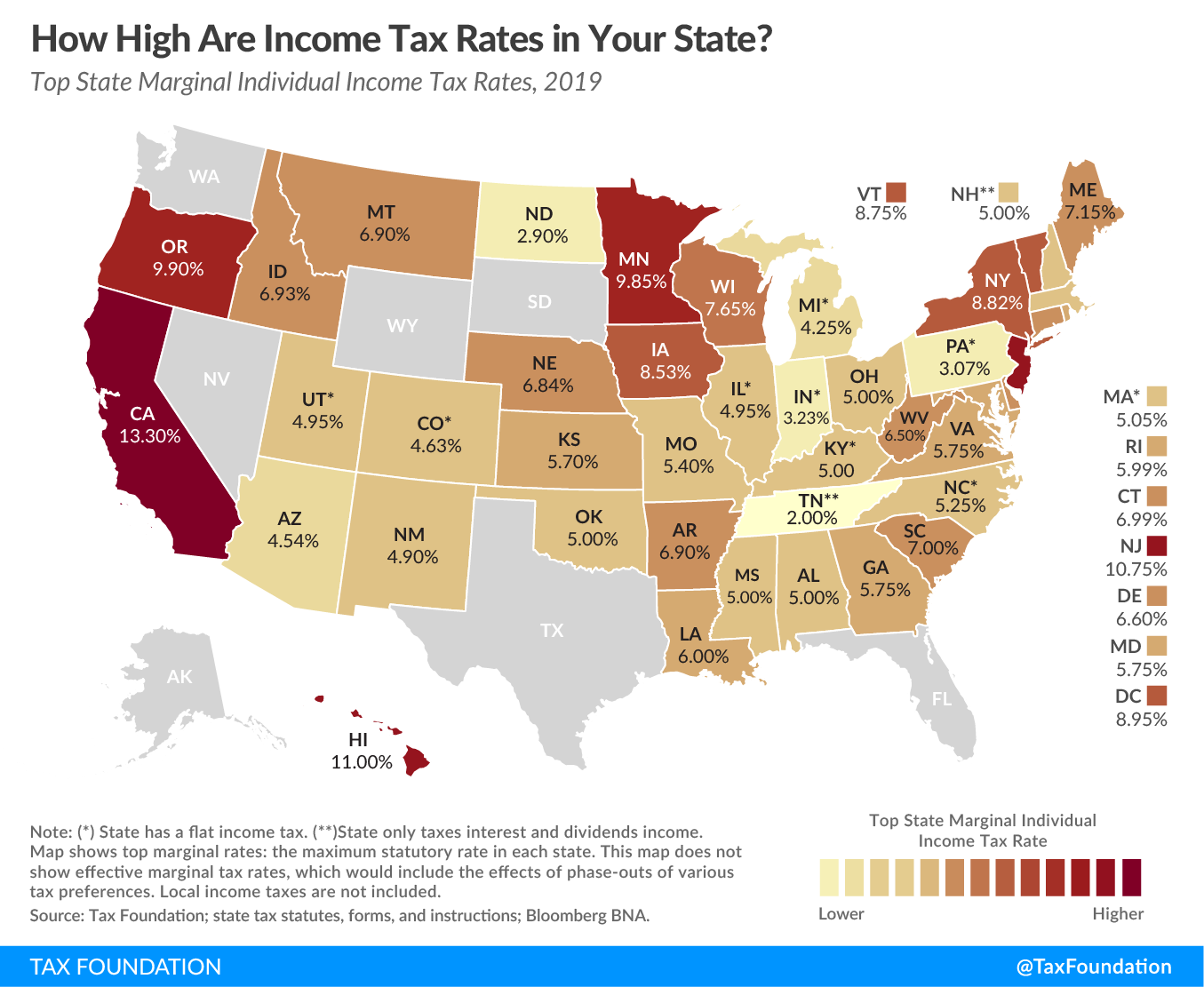

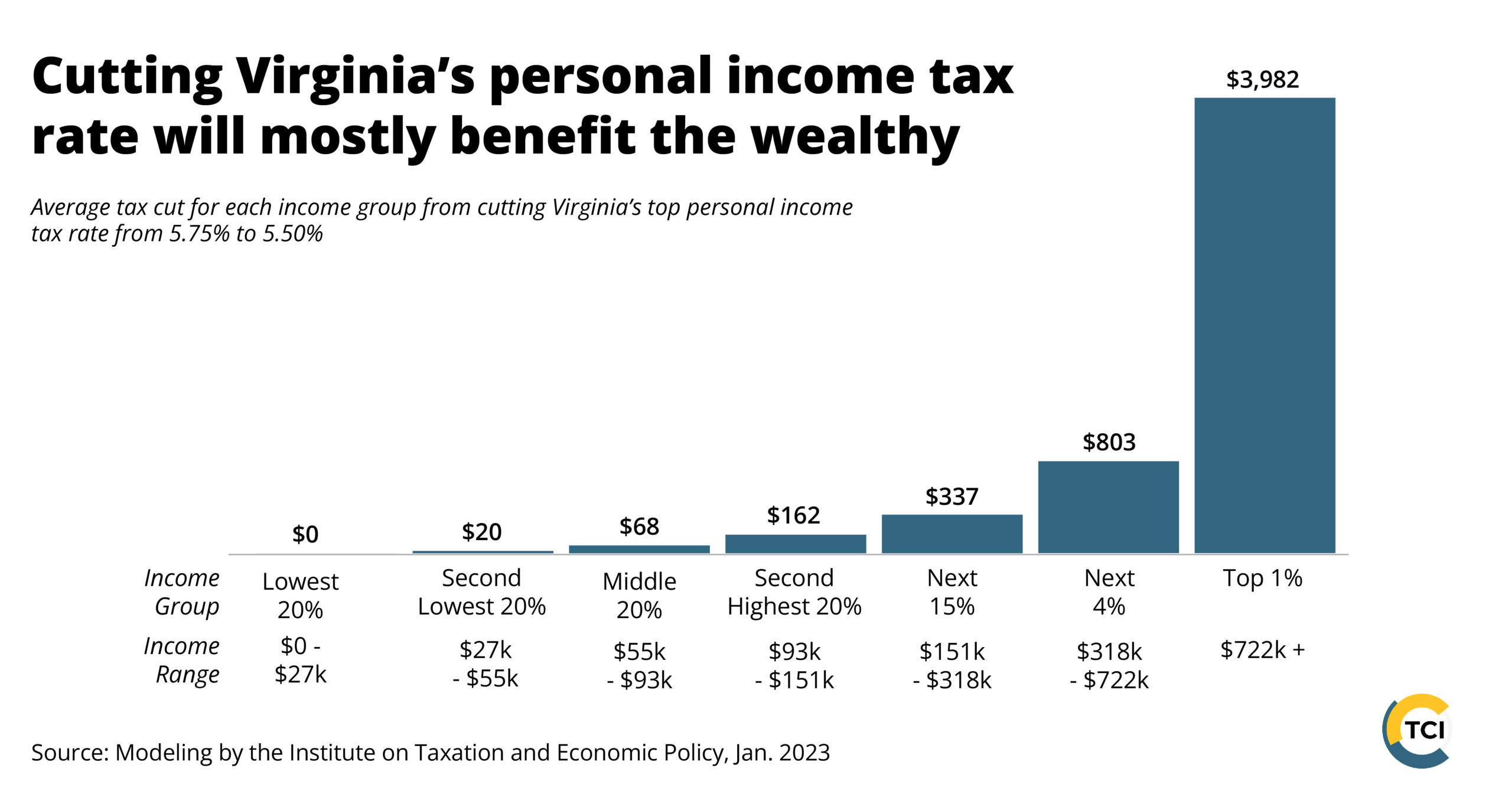

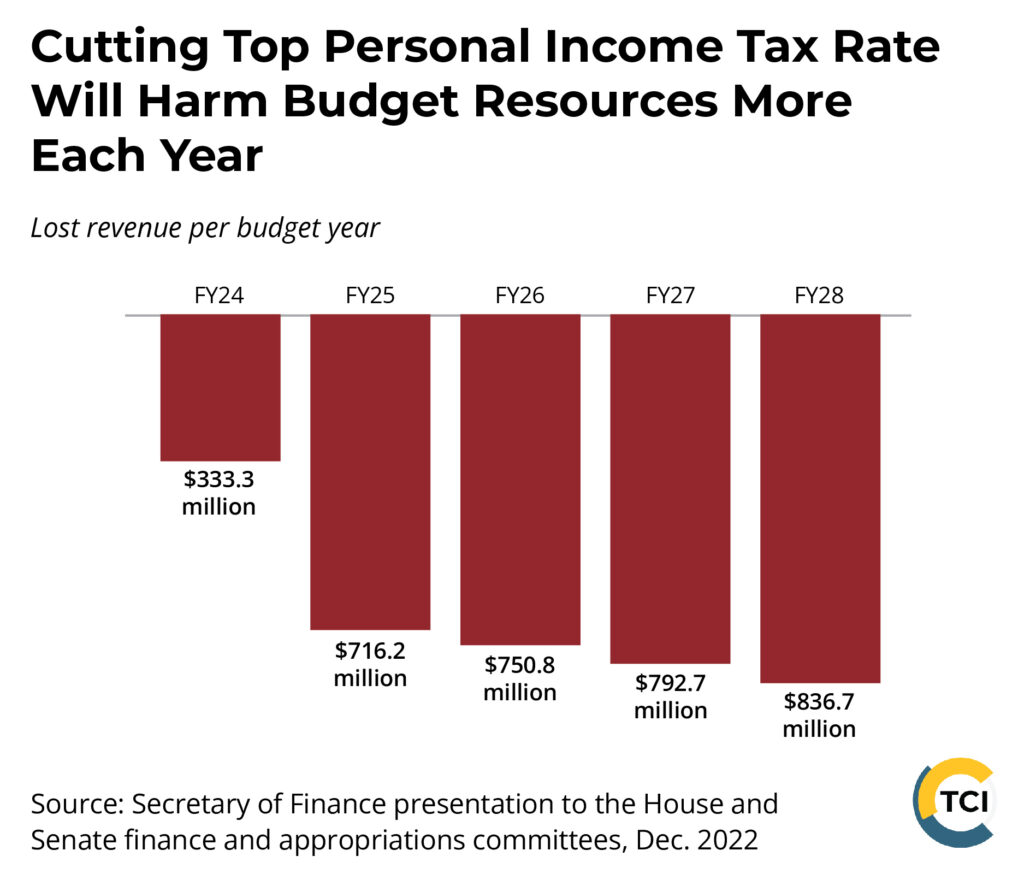

Cutting Top Personal Income Tax Boosts the Wealthy, Excludes People with Lower Incomes - The Commonwealth Institute - The Commonwealth Institute

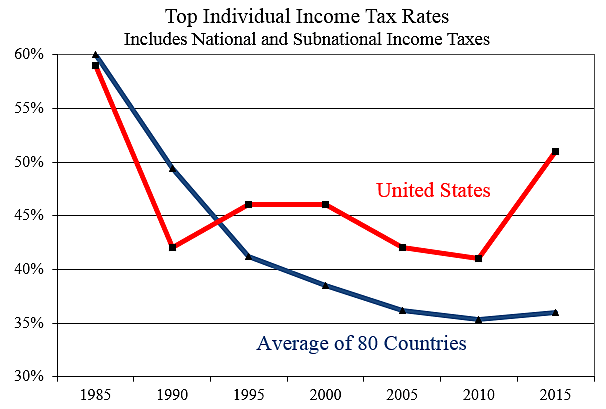

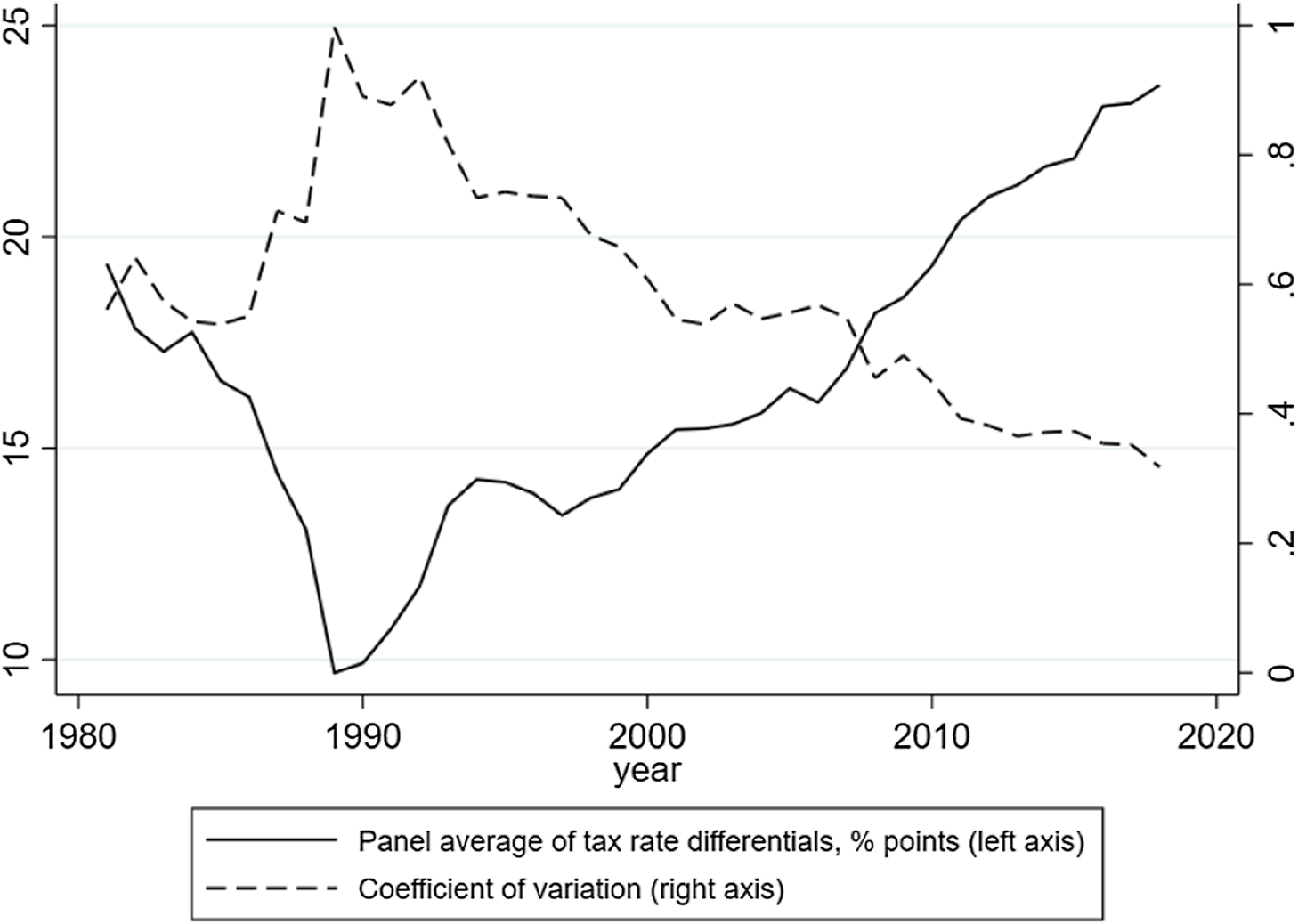

Determinants of top personal income tax rates in 19 OECD countries, 1981–2018 | Journal of Public Policy | Cambridge Core

Cutting Top Personal Income Tax Boosts the Wealthy, Excludes People with Lower Incomes - The Commonwealth Institute - The Commonwealth Institute