The abolition of Class 2 National Insurance: Introducing a benefit test into Class 4 National Insurance for the self-employed - GOV.UK

Take action if you filed your 2019/20 tax return after 31 January 2021 and paid voluntary Class 2 National Insurance contributions | Low Incomes Tax Reform Group

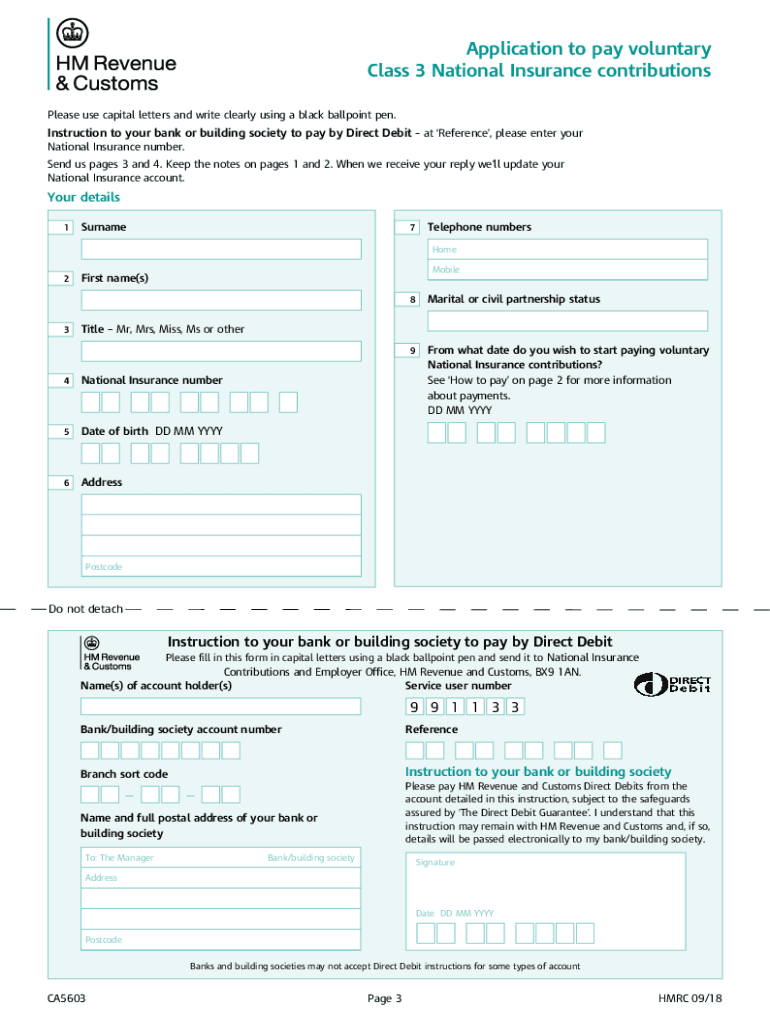

Class 2 National Insurance Reference Number' to Pay Voluntary Contributions? — MoneySavingExpert Forum