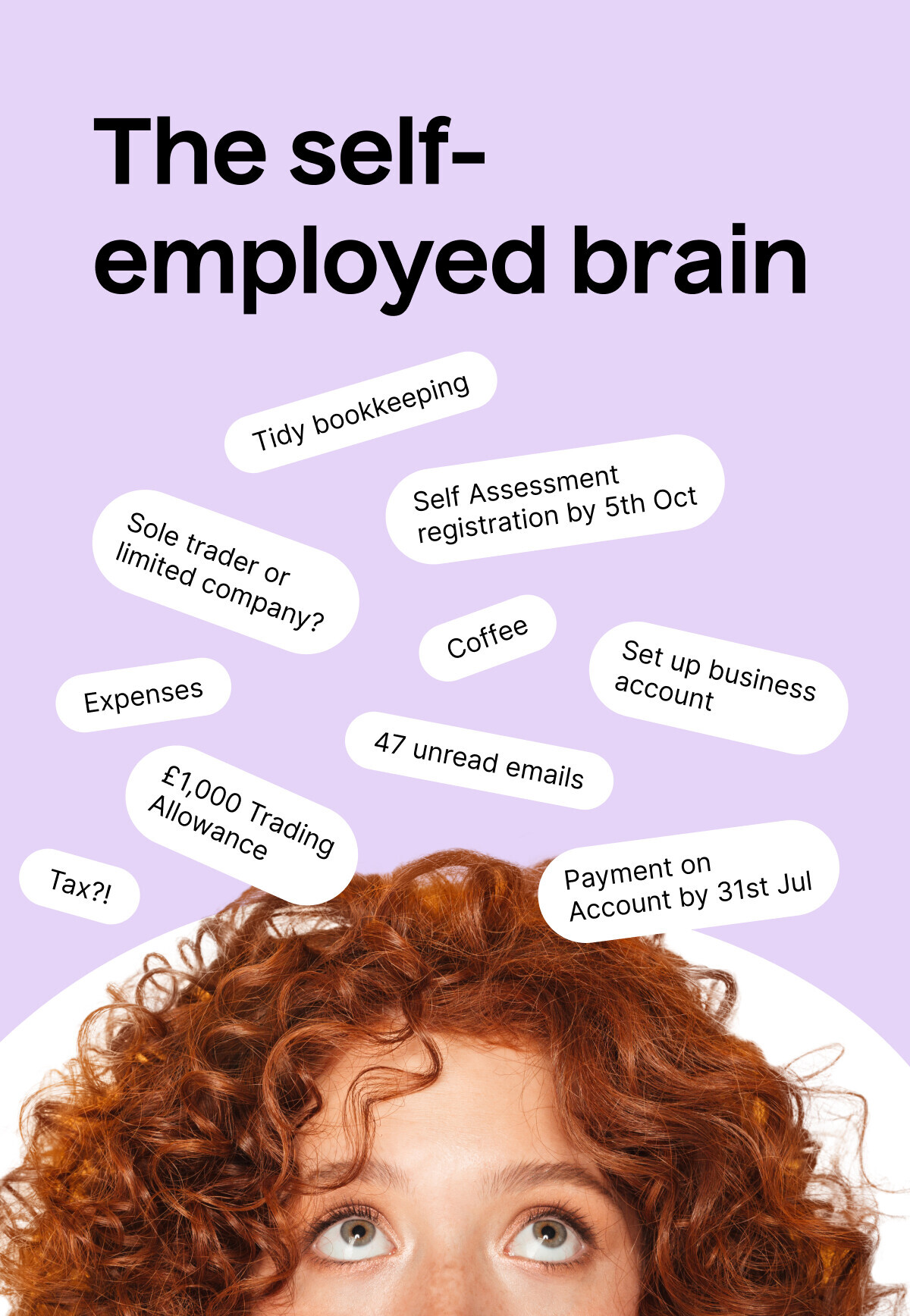

GoSimpleTax - Unsure what you need to fill in on your Self Assessment tax return? Check out our handy list outlining what you'll need 👇 | Facebook

I am a full-time employee do I still have to fill in Self-Assessment tax return - Article Surrey : Taxaccolega

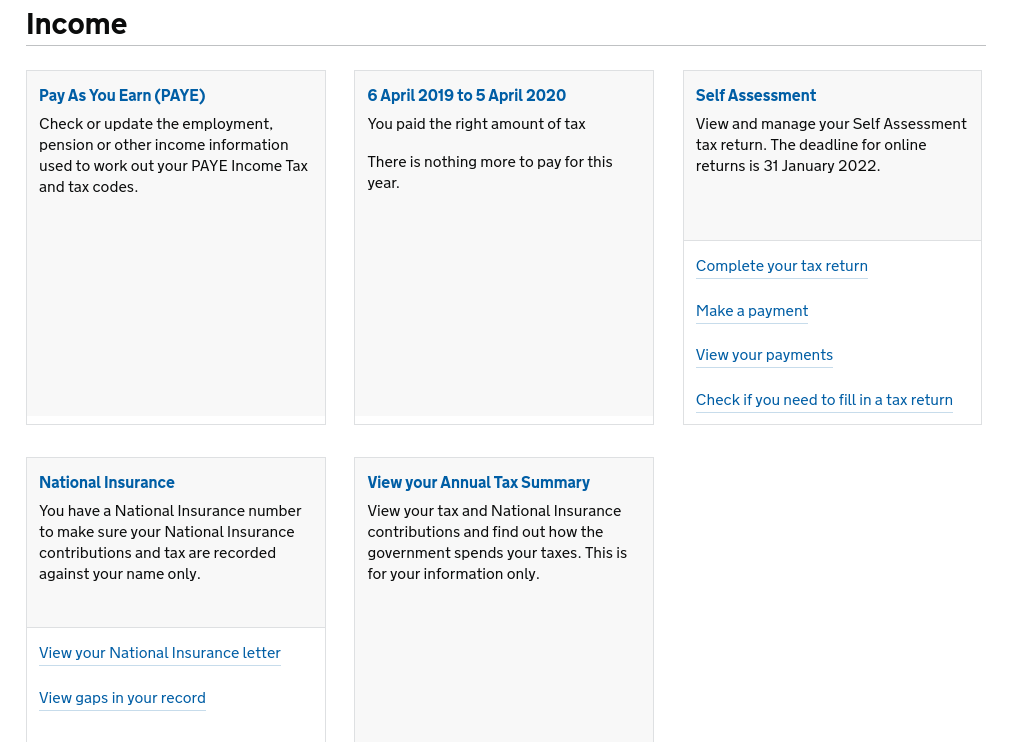

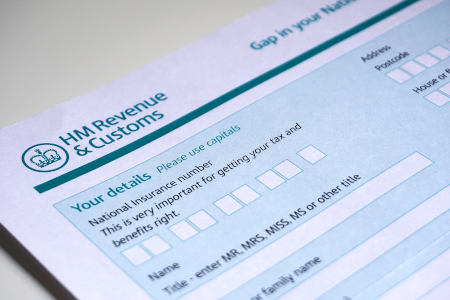

Deadline for 2020/21 self assessment tax returns approaching - AVASK Accounting & Business Consultants