Guidelines for the estimation of LGD appropriate for an economic downturn ('Downturn LGD estimation')

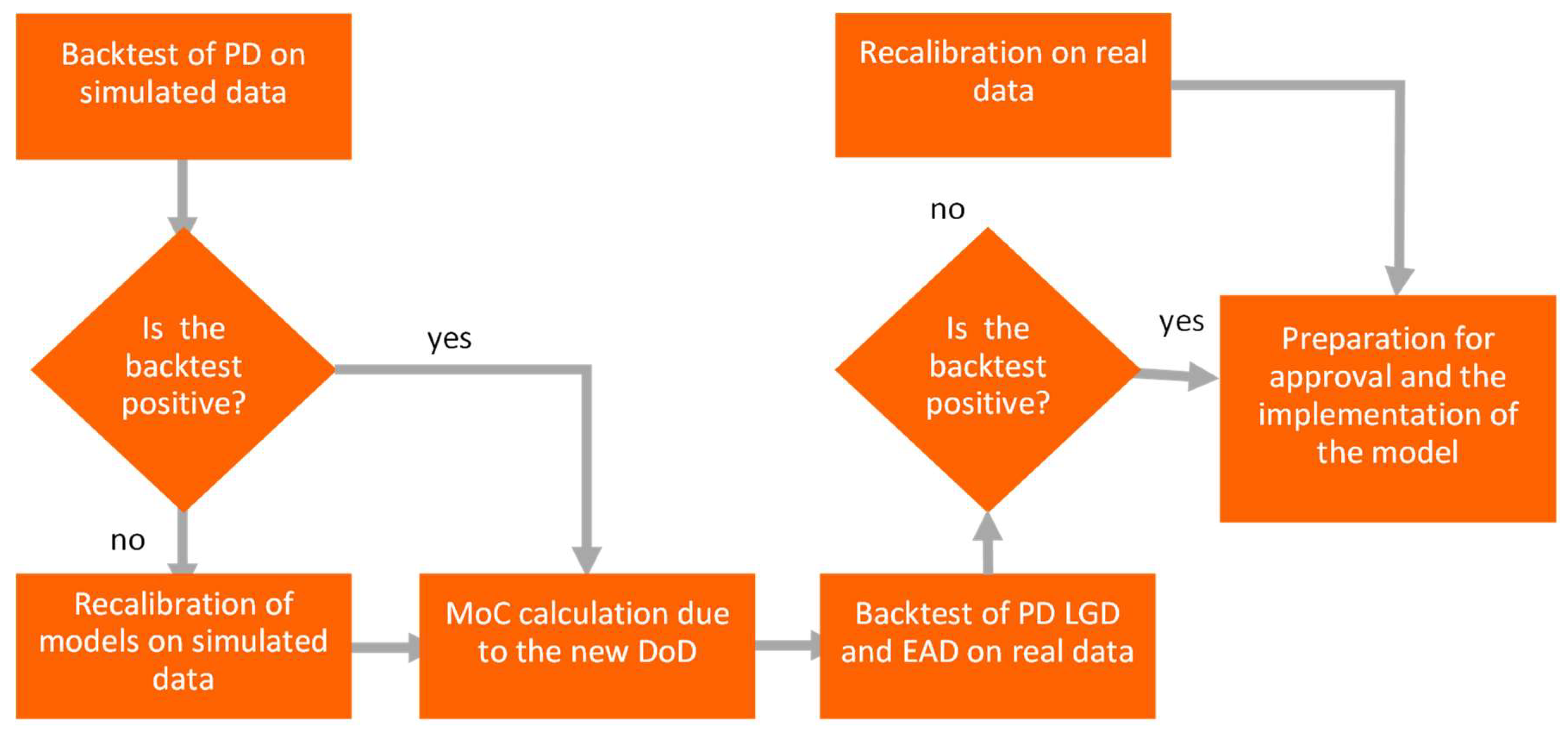

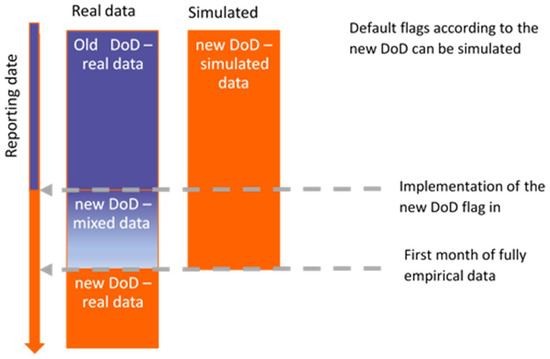

Risks | Free Full-Text | New Definition of Default—Recalibration of Credit Risk Models Using Bayesian Approach

Risks | Free Full-Text | New Definition of Default—Recalibration of Credit Risk Models Using Bayesian Approach

Margin of Conservatism Framework for IRB PD, LGD and CCF: Liu, Yang: 9783668995420: Amazon.com: Books

![PDF] Econometric approach for Basel II Loss Given Default Estimation : from discount rate to final multivariate model | Semantic Scholar PDF] Econometric approach for Basel II Loss Given Default Estimation : from discount rate to final multivariate model | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/fc954a9ac25c2fd9f2de67b9f89b53aa36742e6c/10-Table2-1.png)

PDF] Econometric approach for Basel II Loss Given Default Estimation : from discount rate to final multivariate model | Semantic Scholar

Appendix: Draft amendments to Supervisory Statement 11/13 'Internal Ratings Based (IRB) Approaches 12 Probability of default

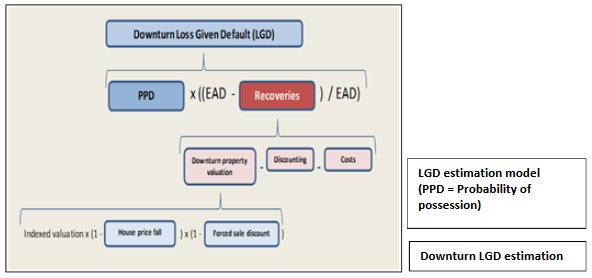

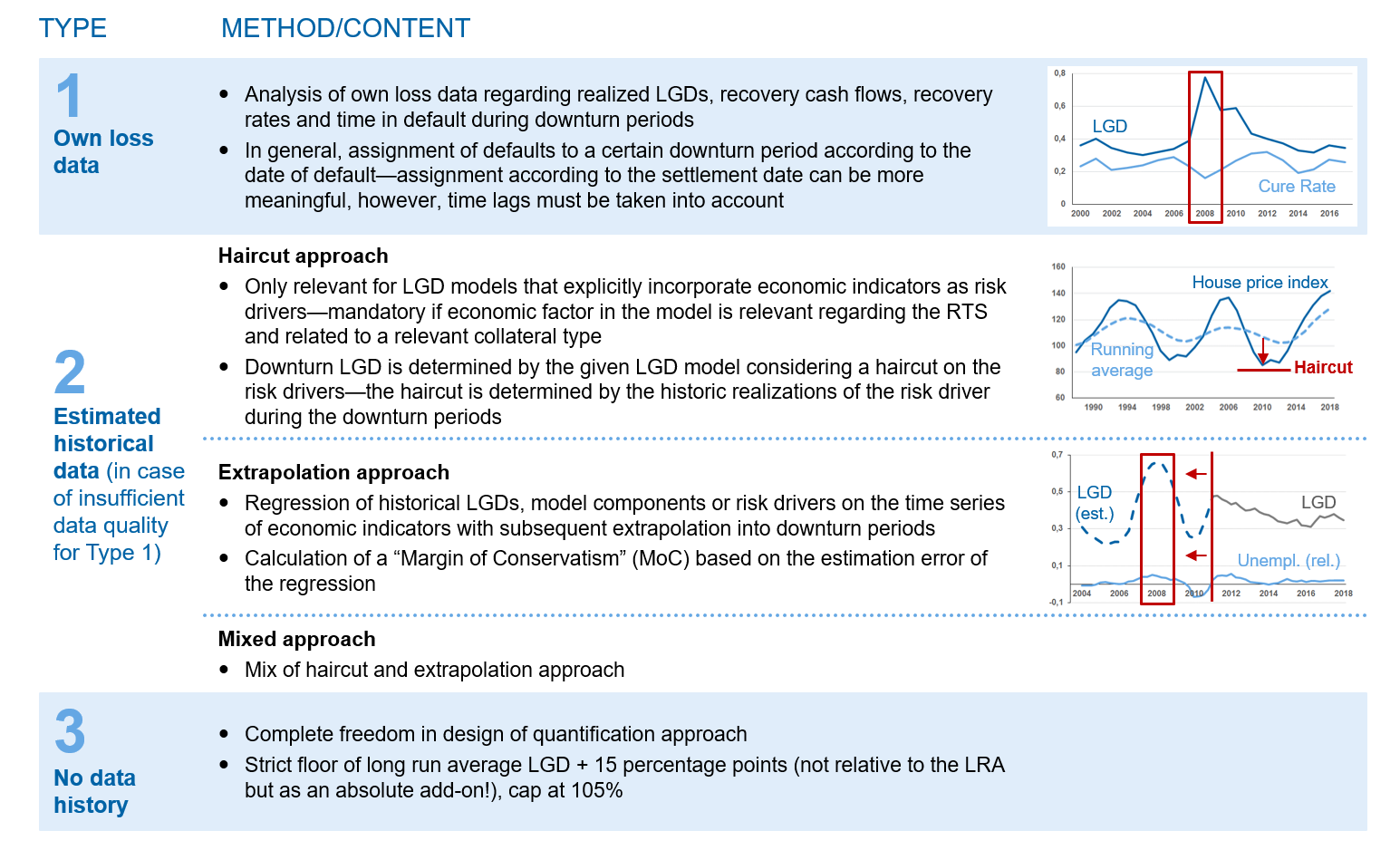

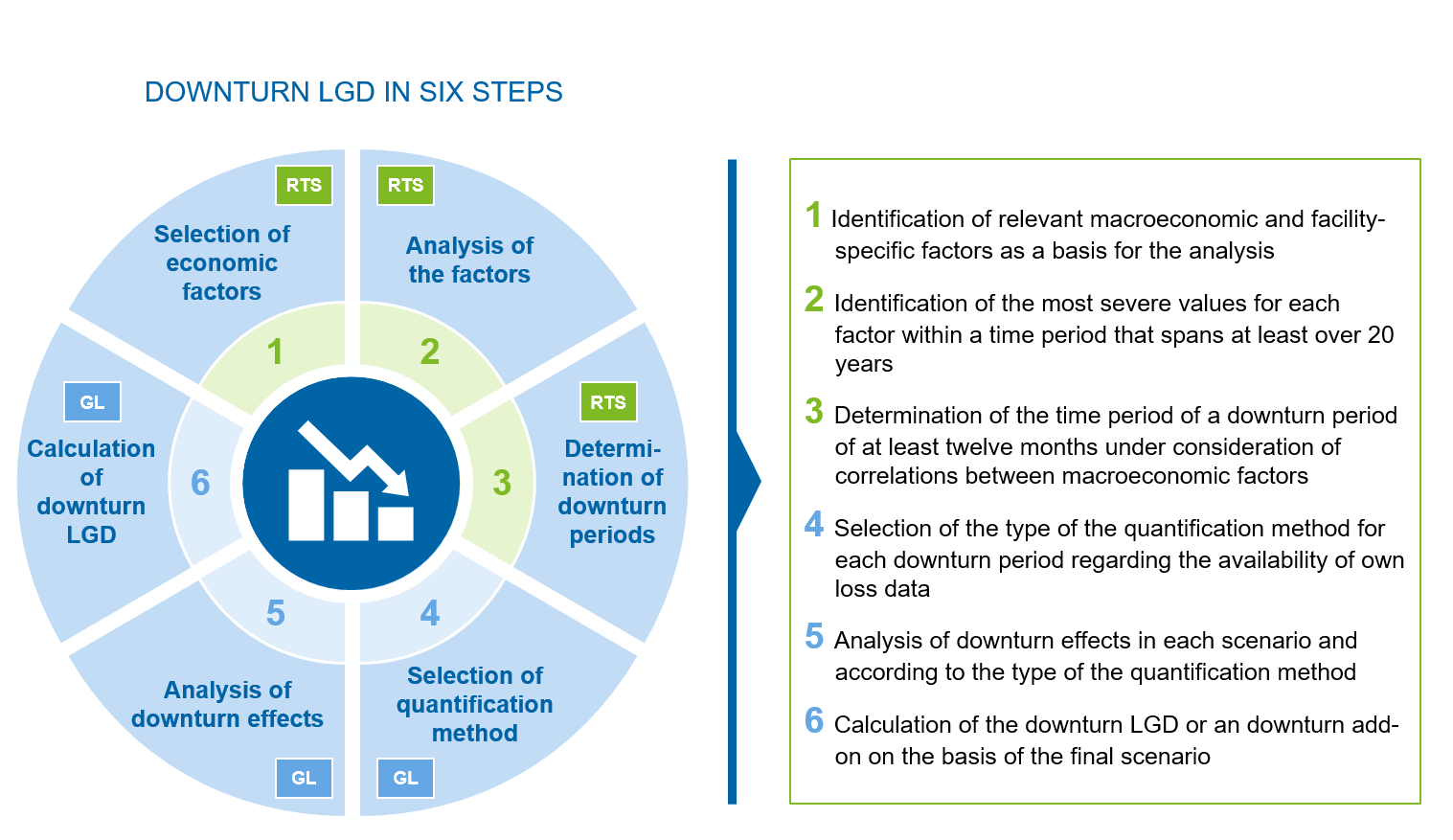

Guidelines on PD estimation, LGD estimation and the treatment of defaulted exposures - EBA/GL/2017/16 23/04/2018

EBF response to EBA consultation on Guidelines on PD estimation, LGD estimation and the treatment of defaulted exposures