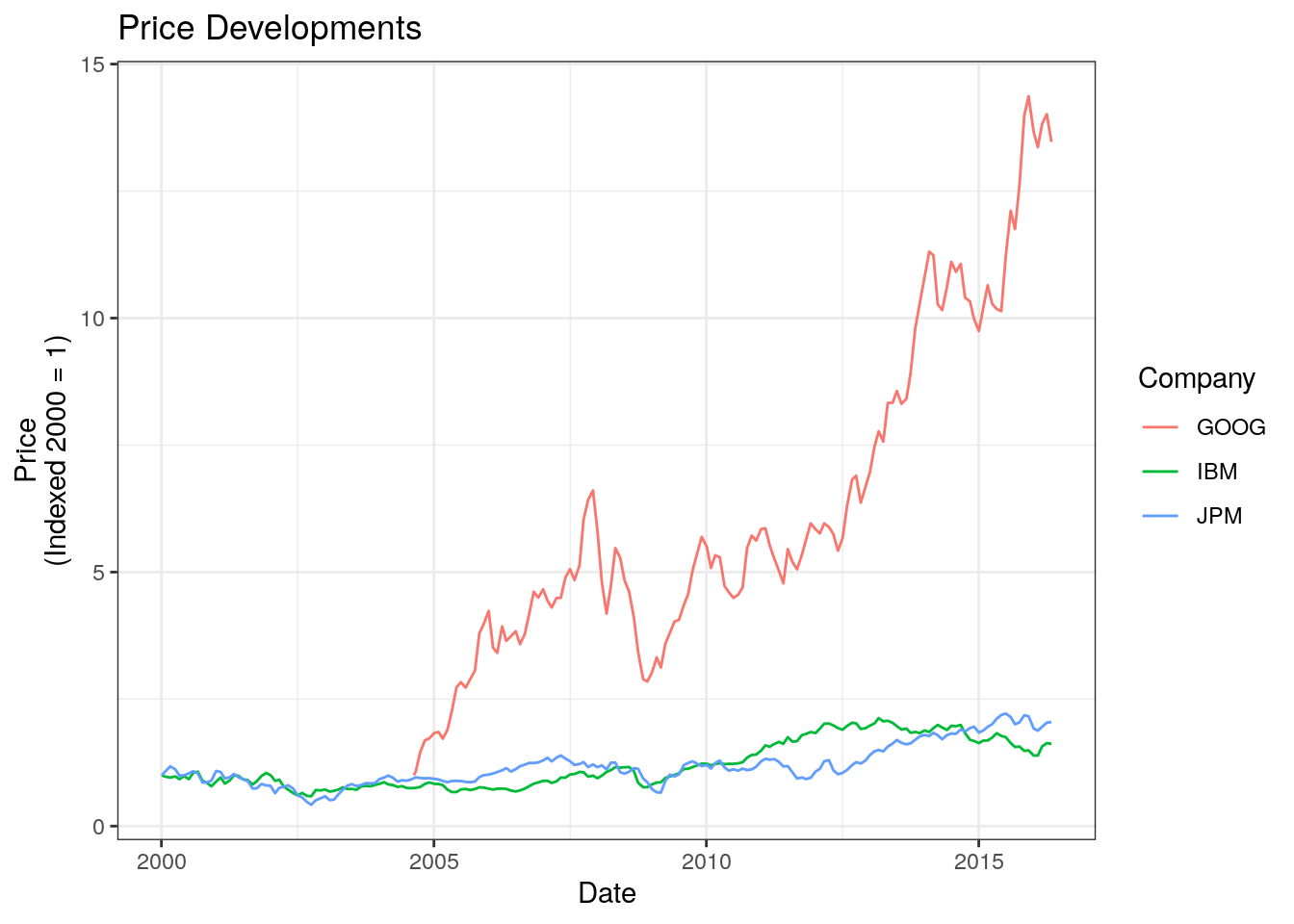

Short selling, margin buying and stock return in China market - Li - 2018 - Accounting & Finance - Wiley Online Library

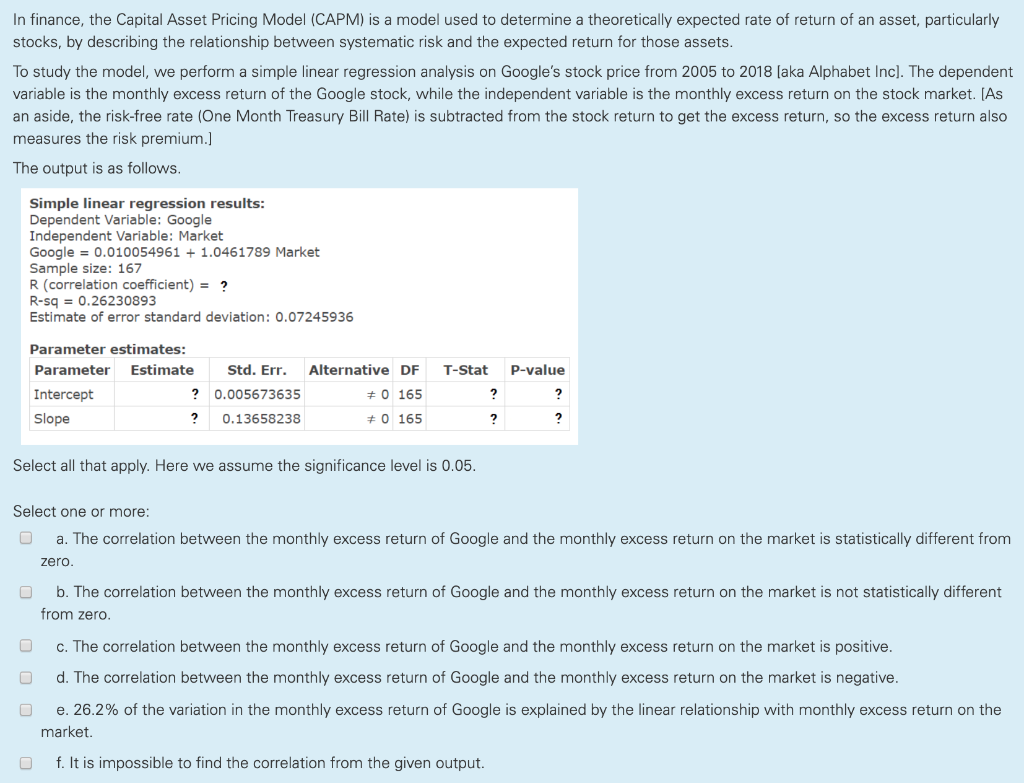

CAPM - Details - ○ ○ ○ ○ ○ CHAPTER Portfolio Theory and the Capital Asset Pricing Model I n Chapter - Studocu

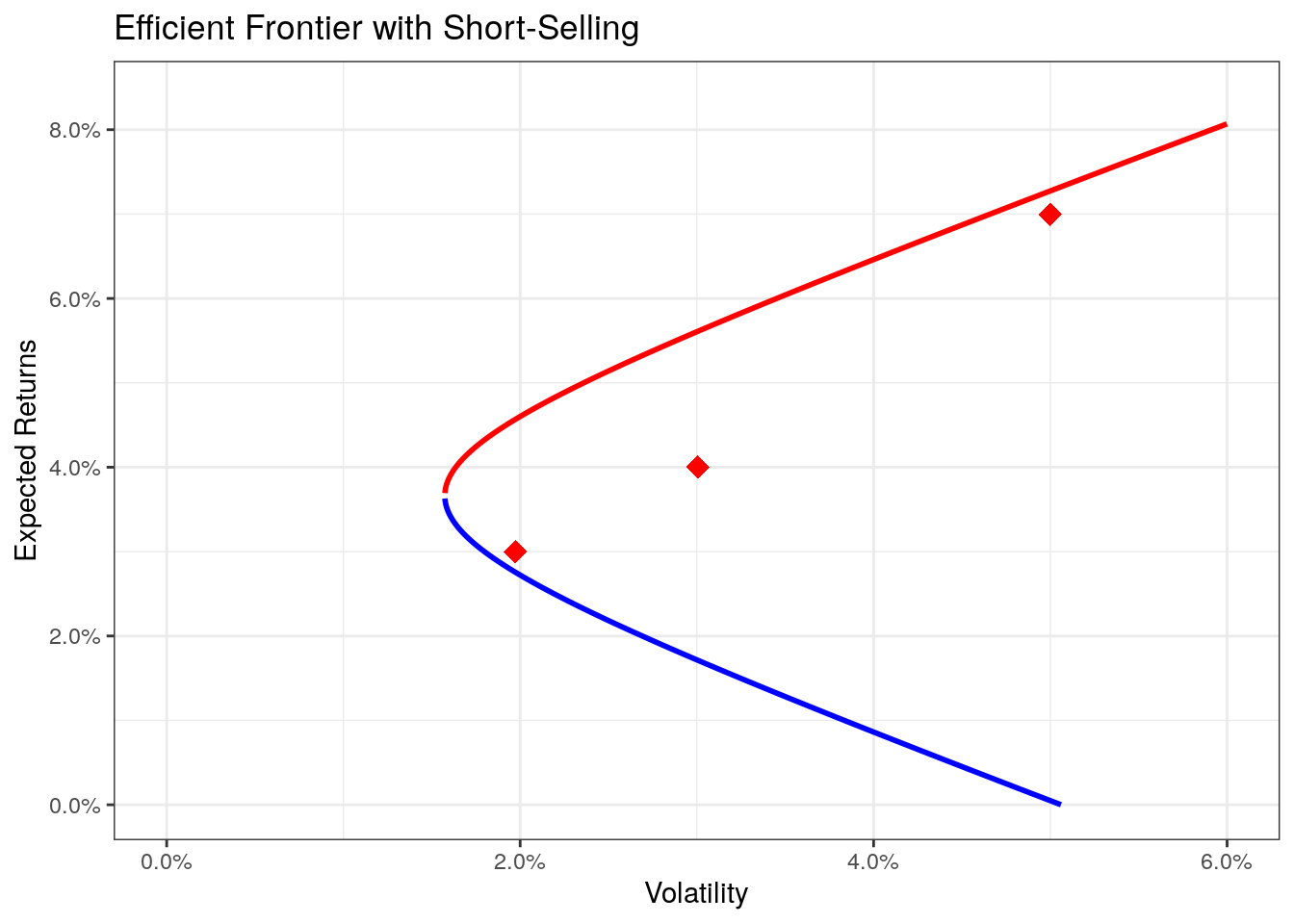

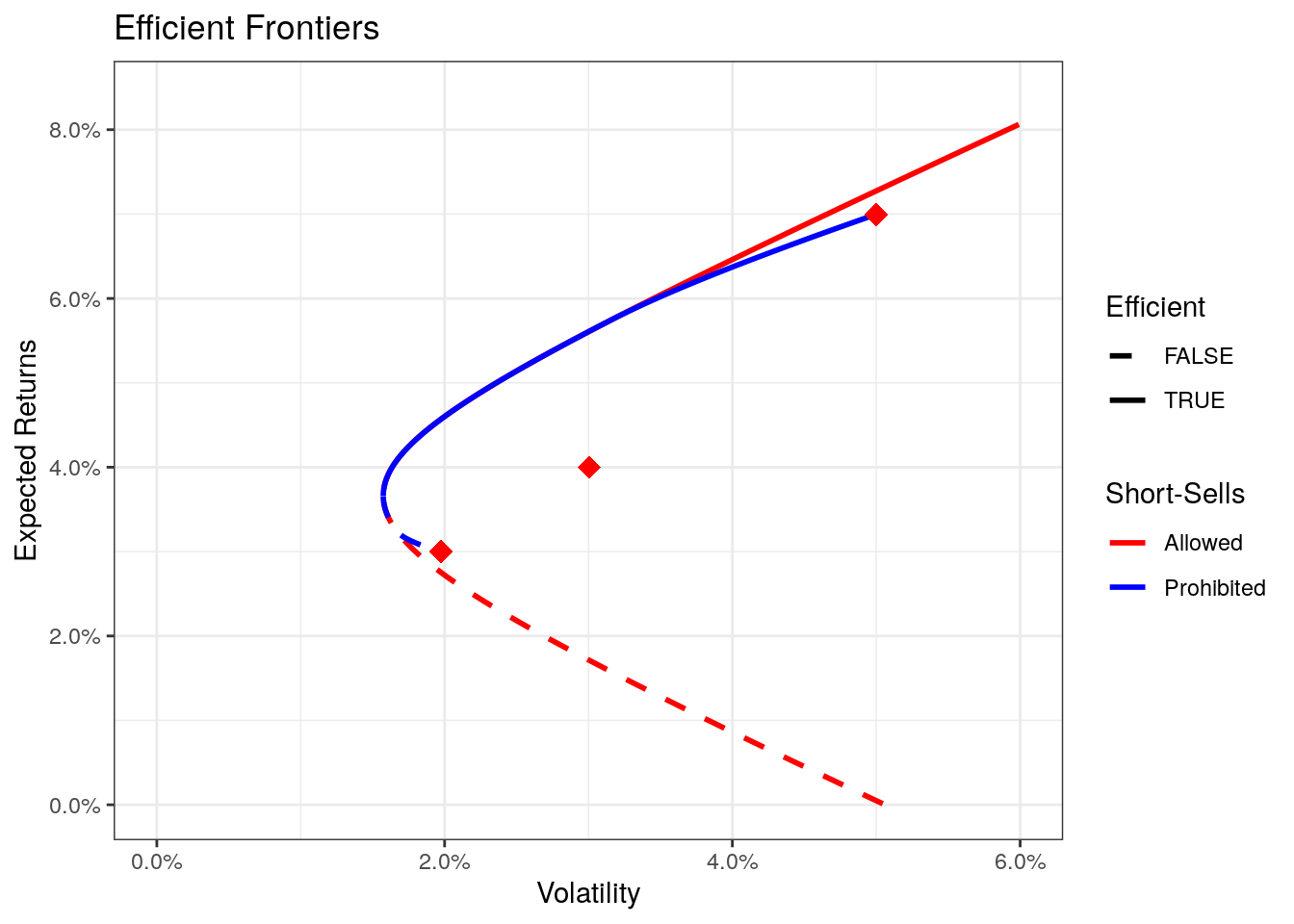

The impact of regulation-based constraints on portfolio selection: The Spanish case | Humanities and Social Sciences Communications

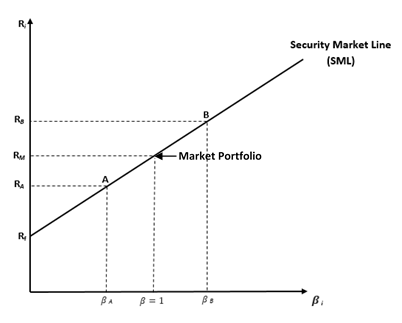

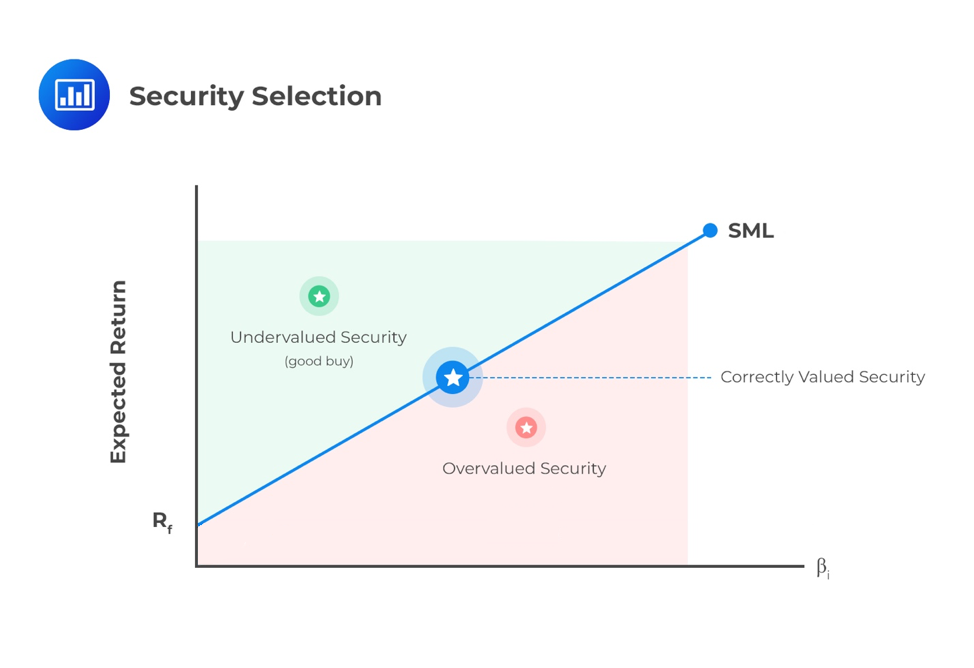

Module 40-43: Systematic Risk & Beta, CAPM, SML, Portfolio Planning and Construction, Risk Management, FinTech in IM Flashcards | Quizlet

![PDF] Short-sale constraints and the market portfolio ∗ | Semantic Scholar PDF] Short-sale constraints and the market portfolio ∗ | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/bcad3fe2045bf71a8b220c505884dd61210b870e/19-Table2-1.png)