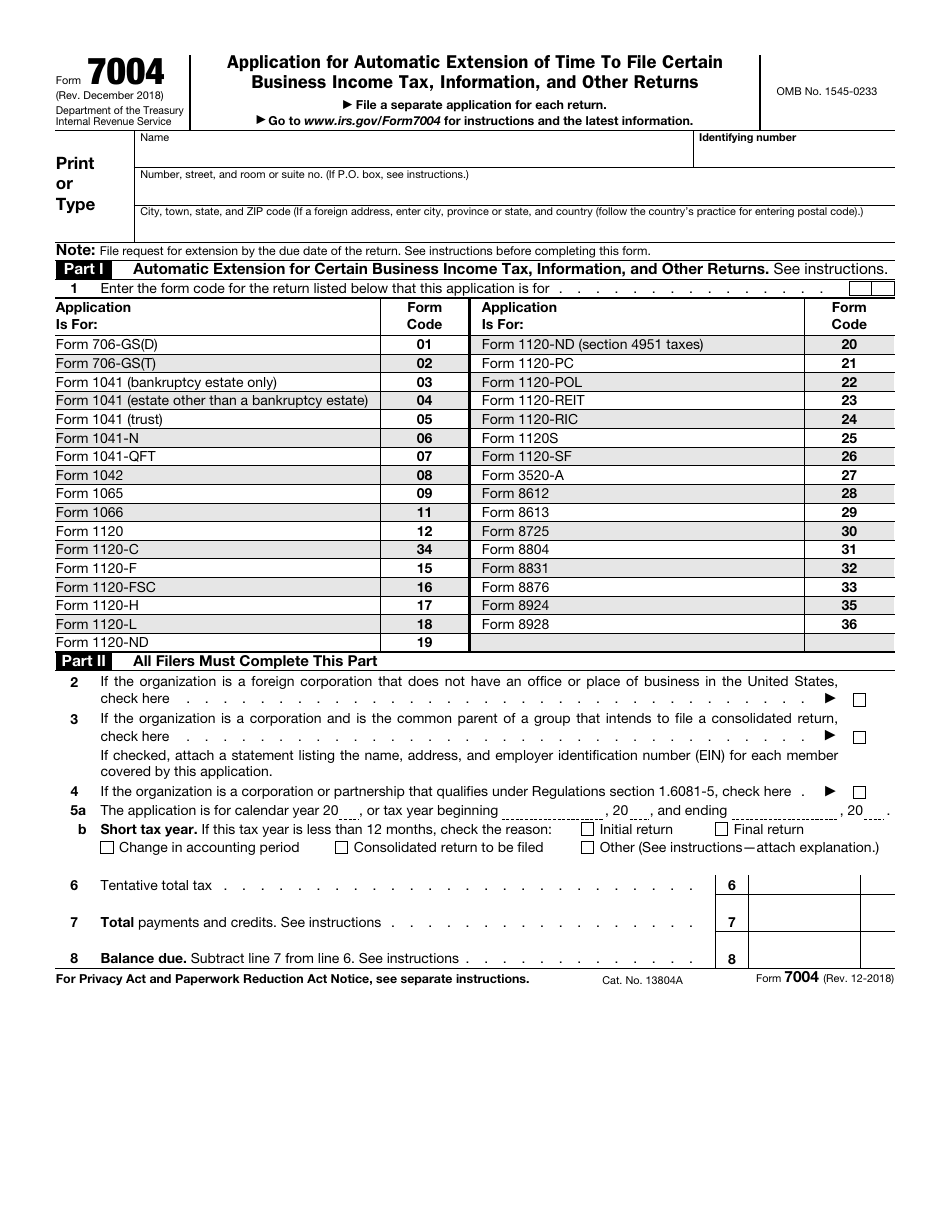

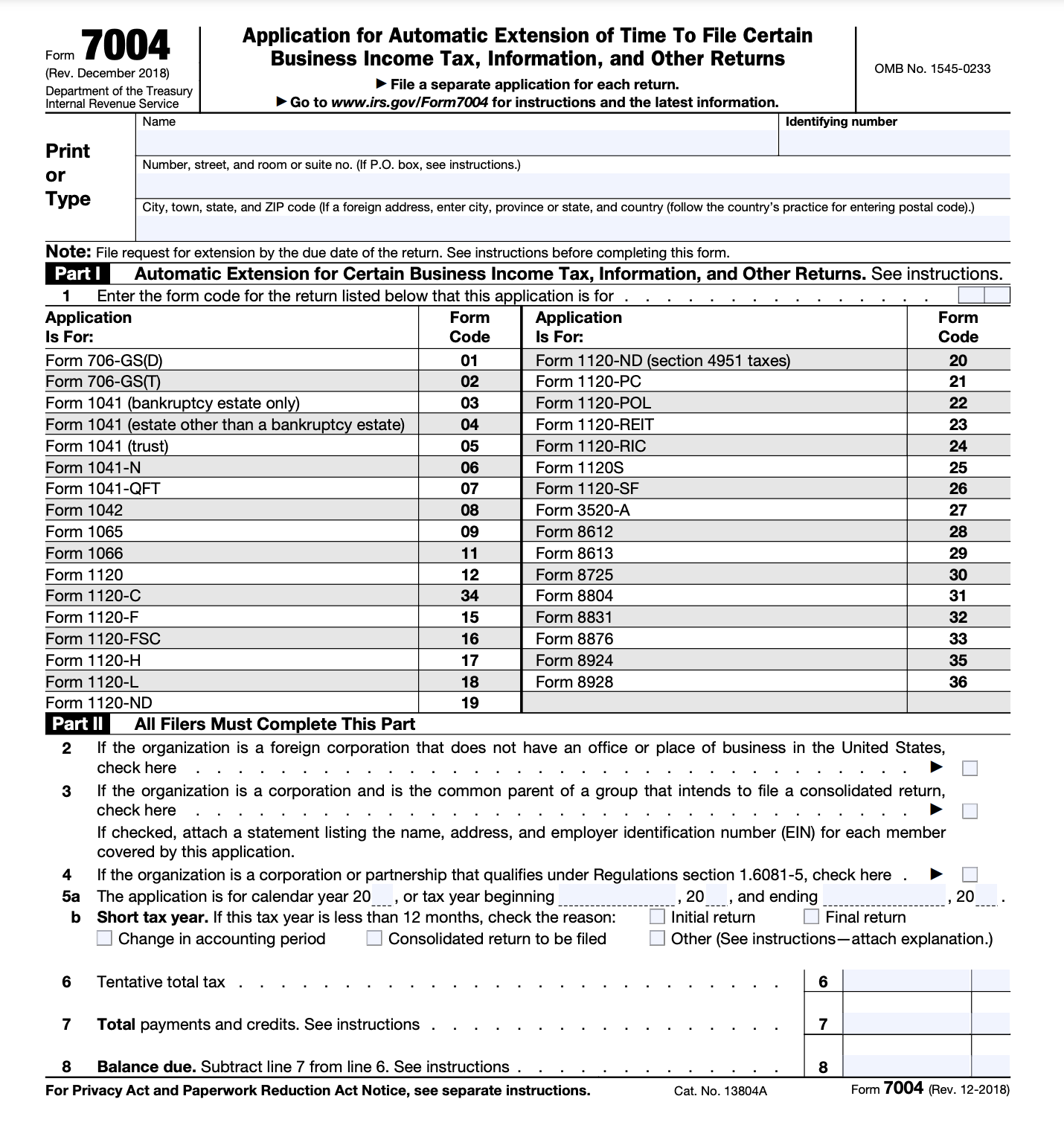

IRS Form 7004 Download Fillable PDF or Fill Online Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns | Templateroller

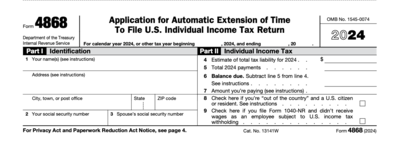

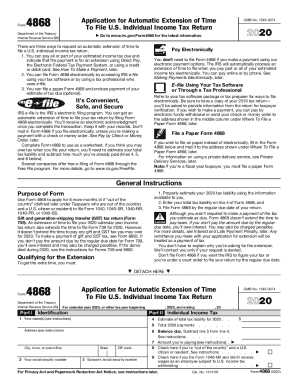

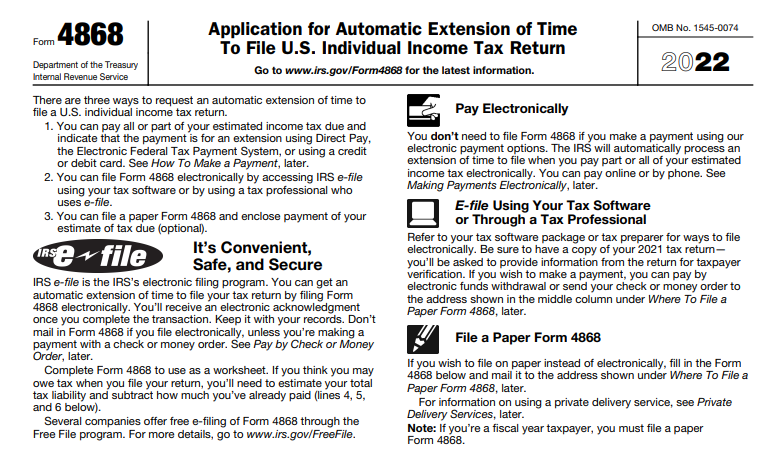

Fillable Online 2020 Form 4868. Application for Automatic Extension of Time To File U.S. Individual Income Tax Return Fax Email Print - pdfFiller

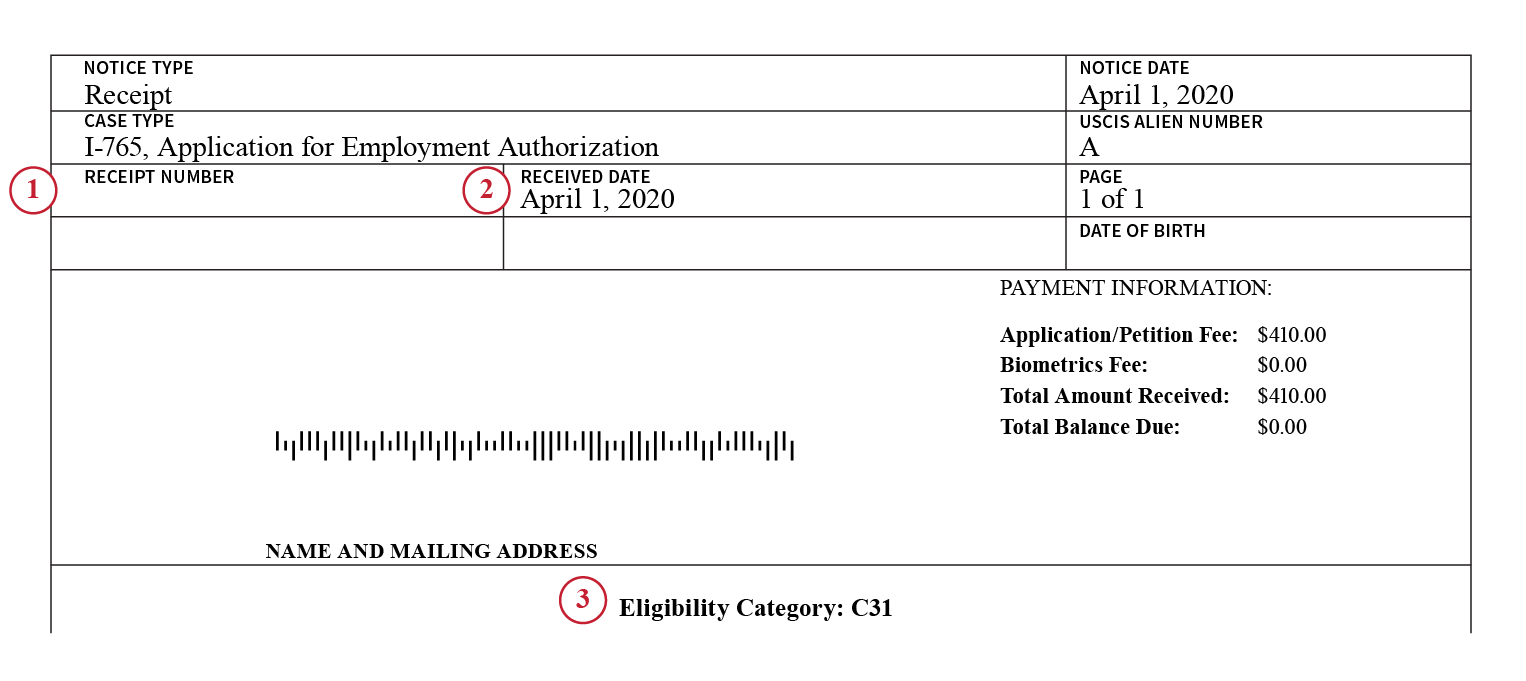

USCIS Temporarily Increases Automatic Extension Period for Certain EAD Applicants - Ogletree Deakins

Federal Register :: Temporary Increase of the Automatic Extension Period of Employment Authorization and Documentation for Certain Renewal Applicants

:max_bytes(150000):strip_icc()/4868now-8776a44cf0674cc0815685077ec42bf7.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-01-03at9.55.39AM-c648b1f5d8bc42e699fad83c7a0d8053.png)

:max_bytes(150000):strip_icc()/Screenshot43-d22959eda68841df96f3e8f1bb223a34.png)